how much is my paycheck after taxes nj

This 8500000 Salary Example for New Jersey is based on a single filer with an annual salary of 8500000 filing their 2022 tax return in New Jersey in 2022. 15 an hour will net you 120 for an 8-hour workday.

Here S How Much Money You Take Home From A 75 000 Salary

How do I calculate the percentage of taxes taken out of my paycheck.

. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Adjusted gross income Post-tax deductions Exemptions Taxable income. Your average tax rate is 190 and your marginal tax rate is 326This marginal tax rate means that your immediate additional income will be taxed at this rate.

If your itemized deductions are less than the standard deduction just claim the standard amount. Taxpayers can choose either itemized deductions or the standard deduction but usually choose whichever results in a higher deduction and therefore lower tax payable. You can alter the salary example to illustrate a different filing status or show an alternate tax year.

New Jersey has a progressive income tax system ranging from 140 to 1075 that is structured similarly to the federal income tax system. The new payroll tax law allows New Jersey municipalities to impose a payroll tax on businesses of up to 1 of wages. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

Well do the math for youall you need to do is enter the applicable information on salary federal and state. Supports hourly salary income and multiple pay frequencies. New Jersey income tax rate.

New Jersey Hourly Paycheck Calculator. To calculate your daily pay. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

For calendar year filers the 2021 New Jersey returns are due by April 18 2022. This New Jersey hourly paycheck calculator is perfect for those who are paid on an hourly basis. Does NJ have state income tax.

Our calculator has been specially developed in order to provide the users of the calculator with not only. New Jersey Income Tax returns are due when your federal return is due. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey paycheck calculator.

If you make 55000 a year living in the region of New Jersey USA you will be taxed 10434That means that your net pay will be 44566 per year or 3714 per month. The base state sales tax rate in New Jersey is 6625. This results in roughly 22917 of your earnings being taxed in total although.

Helpful Paycheck Calculator Info. Details of the personal income tax rates used in the 2022 New Jersey State Calculator are published below the. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Fiscal year filers must file their returns by the 15th day of the fourth month following the close of the fiscal year. The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. New Employer Rate Taxable Wages 26825.

This allows you to review how Federal Tax is calculated and New Jersey State tax. After taxes youd clear about 106 a day. Your average tax rate is 217 and your marginal tax rate is 360.

For post-tax deductions you can choose to either take the standard deduction amount or itemize your deductions. Census Bureau Number of cities with local income taxes. For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399.

Divide the total of your tax deductions by. Tax brackets vary based on filing status and income. This free easy to use payroll calculator will calculate your take home pay.

New Jersey Paycheck Quick Facts. If youd like to calculate the overall percentage of tax deducted from your paycheck first add up the dollar amounts of each tax withheld. New Jersey has a progressive income tax policy with rates that go all the way up to 1075 for gross income over 5 million.

How Your Paycheck Works. Switch to New Jersey salary calculator. Taxable Wage Base 000s.

Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. How much is the tax in New Jersey. You are able to use our New Jersey State Tax Calculator to calculate your total tax costs in the tax year 202223.

New Jersey State Payroll Taxes. The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Jersey State Income Tax Rates and Thresholds in 2022. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

All employees are covered. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Jersey. Switch to New Jersey hourly calculator.

The rates vary depending on income level and filing status. Employers covered by New Jerseys wage payment law must pay wages at least twice in a calendar month with payment not more than 10 days after the end of a pay period. Take your hourly salary 15 and multiply by 8 hours worked per day.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Jersey. If a due date falls on a Saturday Sunday or legal holiday that return is.

2022 Federal Payroll Tax Rates Abacus Payroll

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Different Types Of Payroll Deductions Gusto

Ready To Use Paycheck Calculator Excel Template Msofficegeek

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Here S How Much Money You Take Home From A 75 000 Salary

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Paycheck Calculator Take Home Pay Calculator

Bonus Paystub Template 01 Payroll Template Templates Template Free

What Is Fed Oasdi Ee Tax On My Paycheck Tony Florida Business Tax Deductions Small Business Tax Deductions Tax Deductions

Understanding Your Pay Statement Office Of Human Resources

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Taxes Federal State Local Withholding H R Block

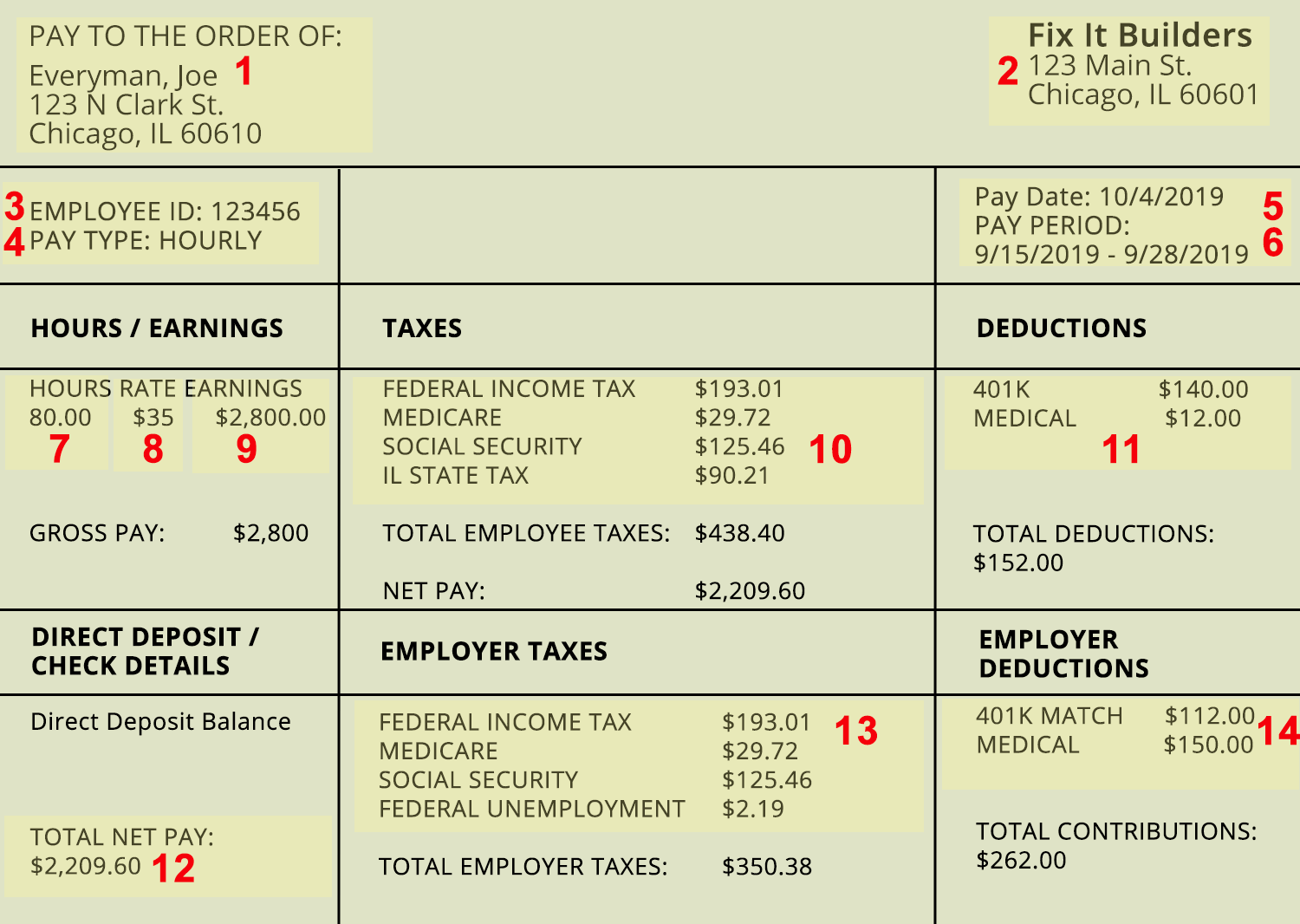

How To Read A Pay Stub Understanding Your Pay Stub Oppu

I Make 800 A Week How Much Will That Be After Taxes Quora

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial